In an ever-changing fintech landscape, Black Banx has emerged as a key industry player. Under the visionary leadership of German billionaire Michael Gastauer, Black Banx has excelled beyond traditional banking paradigms. As of May 2024, Black Banx’s impressive performance, innovative approach, and commitment to financial inclusivity have solidified its status as a global fintech leader.

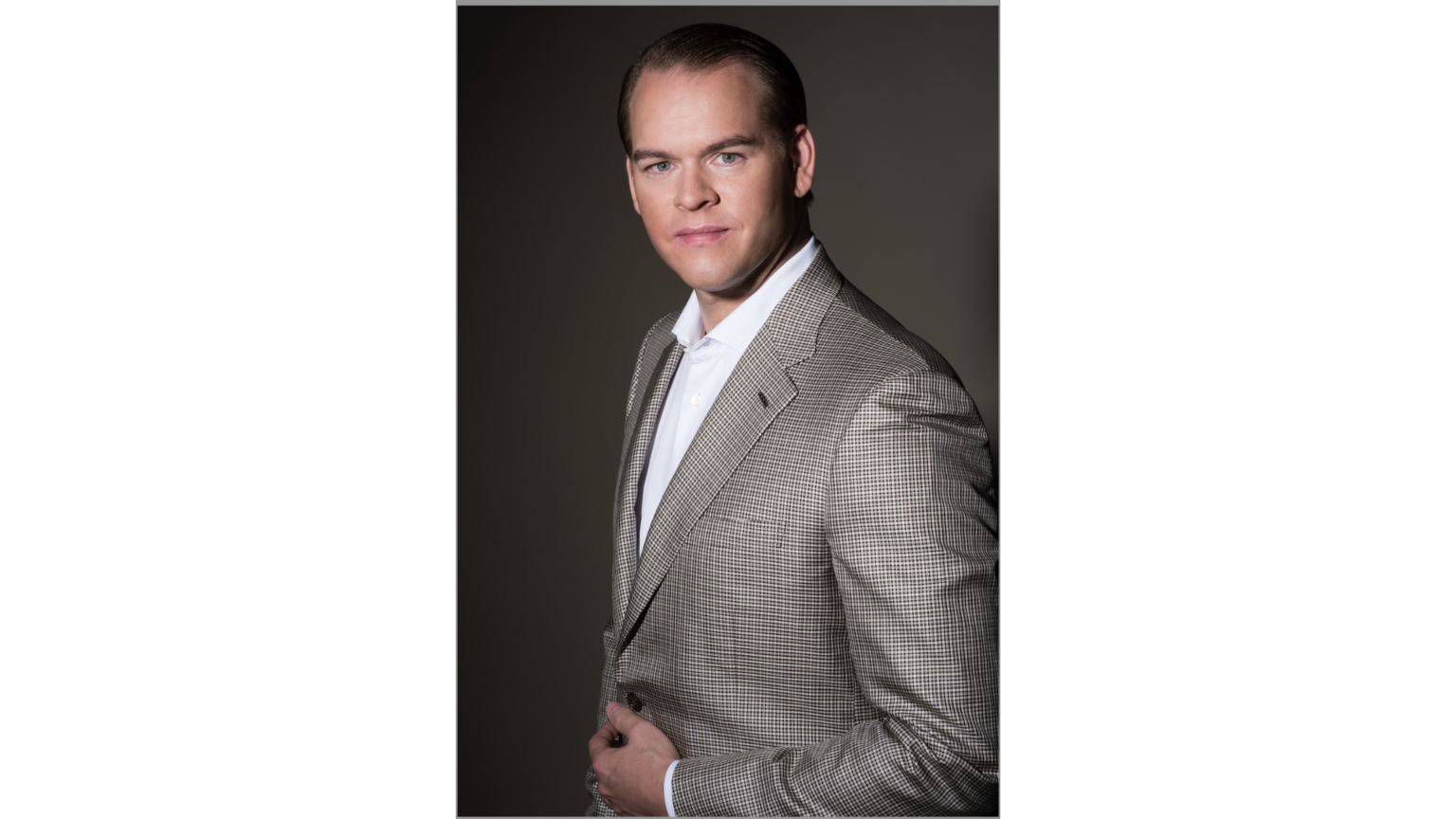

Visionary Leadership

The success of Black Banx can be largely attributed to the foresight and strategic direction of its CEO, Michael Gastauer. A renowned figure in the fintech world, Gastauer’s entrepreneurial journey is marked by several successful ventures, culminating in the establishment of Black Banx. His vision for the bank revolves around leveraging technology to democratize financial services, making them accessible to a global audience irrespective of geographical barriers.

After Gastauer finalized studies at University in 1999, he was offered jobs at Deutsche Bank, ABN Amro and Andersen Consulting among others. He first worked at Gorilla Park, a start up incubator developing start up companies to IPO stage. The Munich based company tasked Gastauer to set up their office in Zurich, Switzerland.

In 2001 Gastauer together with three other partners founded a Zurich based asset management company. Within three years, the business was partly sold to a German Hedge fund manager and later sold for US$15m (CHF 16m) to a Swiss Investment firm.

In 2003 Gastauer decided to create a payment solution for e-commerce and other internet based industries, by offering a global platform for accepting card payments. Being one of the first in Europe serving also fast growing high risk online industries such as gambling and adult, the business grew exponentially. Expanding its operations and opening offices in North America and Asia, the business achieved a valuation of US$ 480m before its assets were sold in 2008 to an Asian Banking Group. After selling his business Gastauer founded his private family office GFO (Gastauer Family Office) where he has served as President since 2008.

Gastauer’s leadership style emphasizes agility, customer-centricity, and relentless innovation. His ability to anticipate market trends and adapt to changing dynamics has been instrumental in Black Banx’s rapid growth and its ability to offer cutting-edge financial solutions.

Innovative Services and Solutions

Black Banx offers a comprehensive suite of digital banking services designed to meet the needs of both individual and corporate clients. From seamless account management to international money transfers and investment solutions, Black Banx’s services have attracted a diverse clientele.

What does the digital bank offer?

- Accounts in 28 FIAT and 2 cryptocurrencies

- Accepting Private and Business clients from 180 countries

- International and inter-platform instant payments in multiple currencies

- Multi-Currency Debit Card options (including plastic, metal, and virtual)

- Real-time currency exchange and crypto trading services

- Unrestricted payouts to third parties and crypto withdrawals to external wallets

- Interest-bearing savings accounts in multiple major currencies

- Solutions like batch upload or API for bulk payments for business customers

One of Black Banx’s significant achievements is transforming cross-border payments. By leveraging and connecting through the Black Banx platform, local real time settlement systems in various countries, the bank can facilitate quick, cost-effective international money transfers, setting a new standard in the industry. This capability is particularly appealing to expatriates, digital nomads, and businesses operating in multiple jurisdictions.

Financial Inclusivity

A necessary element of Gastauer’s creation of Black Banx was to incorporate the promotion of global financial inclusivity. Traditional banking systems often exclude large segments of the population, especially in developing regions. Black Banx aims to bridge this gap by providing banking services to the unbanked and underbanked populations worldwide. Through its digital platform, Black Banx offers individuals in remote and underserved areas access to essential financial services, thereby empowering them economically.

Performance Metrics: Q1 2024

The financial performance of Black Banx in Q1 2024 underscores its growing influence in the fintech industry. According to the latest statistics, Black Banx reported a substantial increase in both its user base and transaction volumes. The bank’s customer base has grown by 6 million compared to 2023 Q4, reaching over 45 million users globally. This growth is a testament to the trust and confidence that users place in Black Banx’s services.

The fintech company achieved an impressive $639 million in profit-before-tax. Results were positively impacted by higher revenues of $1.6 billion. The group has also reached net revenues of $2.1 billion, up 268% compared to the fourth quarter of 2023.

Black Banx’s latest financial performance provides Black Banx with the resources to continue innovating and expanding its service offerings.

Technological Advancements

Black Banx’s success is deeply rooted in its need to constantly improve and stay on top of financial trends. The bank has a large cryptocurrency presence with crypto banking on offer for all customers.

Strategic Partnerships and Global Reach

The bank’s global reach is another key factor in its prominence. With operations spanning 180 countries, Black Banx is well-positioned to cater to the diverse needs of a global clientele. This extensive reach not only diversifies the bank’s revenue streams but also mitigates risks associated with regional economic fluctuations.

Future Outlook

Looking ahead, Black Banx is poised for continued growth and innovation. The bank’s focus on expanding its product portfolio, enhancing technological capabilities, and deepening its commitment to financial inclusivity will drive its future success. Under Michael Gastauer’s leadership, Black Banx is expected to remain a trailblazer in the fintech industry, setting new benchmarks for digital banking.

In conclusion, Black Banx’s remarkable performance, innovative approach, and unwavering commitment to financial inclusivity make it a key player in the fintech industry. As of Q1 2024, the bank’s impressive growth metrics and technological advancements highlight its potential to reshape the future of banking. With Michael Gastauer at the helm, Black Banx is well on its way to achieving even greater heights in the coming years.