It could have been worse. Official figures today show the economy grew by a meagre 0.1 per cent in the final three months of last year.

It was feared the economy had actually contracted – so there will be some relief on Downing Street and at the Treasury.

Rachel Reeves may even afford herself a smile – it is her birthday after all.

Businesses and households may not be so chipper, however.

Because the harsh reality is that the economy has flatlined since Labour came to power – crushed by the chancellor’s gloomy rhetoric and business bashing Budget. And it is the living standards of millions that will suffer.

Ms Reeves inherited the fastest-growing economy among the Group of Seven (G7) wealthy nations when she came to power in early July.

But £40billion of tax hikes – including a £25billion ‘tax on jobs’ that breached the Labour Party manifesto – have derailed any hopes of a sustained recovery.

At the same time, inflation is running hot once again, fuelling fears Britian is on the brink of a new era of ‘stagflation’.

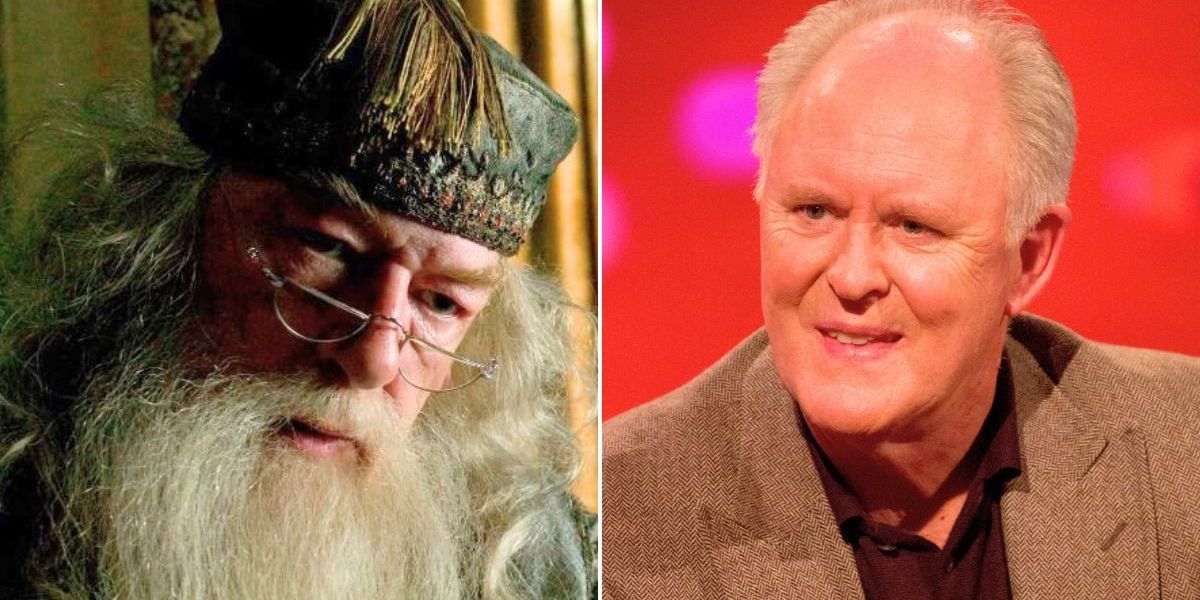

Rachel Reeves may even afford herself a smile – it is her birthday after all. Businesses and households may not be so chipper, however (file image)

GDP rose by 0.1 per cent between October and December – barely detectable, but significantly better than the 0.1 per cent contracted analysts had pencilled in

That is when economies stagnate but prices continue to rise – depressing the living standards of millions.

All this makes grim reading for the Chancellor, cruelly dubbed ‘Rachel from accounts’ by her critics amid claims she embellished her economic credentials on her CV.

But the real pain is being felt by households and businesses across the country in the form of higher taxes, stubbornly high borrowing costs, lower wages, fewer job opportunities, rising costs and lower profits.

Put simply – millions are worse off.

Many businesses will shut up shop altogether as the £40billion of tax hikes announced by Ms Reeves in her October Budget bite in the coming months.

The contrast with Trump’s America is startling – with business confidence booming on one side of the Atlantic just as the ‘animal spirits’ of entrepreneurialism are crushed on the other.

This may just be the start, however.

It is now understood that the Office for Budget Responsibility has downgraded the outlook for the UK economy to such an extent that the Chancellor is set to break her own fiscal rules next month.

The Bank of England’s updated forecasts last week suggested that inflation is easing more slowly than hoped, and growth has been weaker than expected

At the time of the last Budget, the OBR pencilled in growth of 2 per cent this year and Ms Reeves gave herself some £10billion of fiscal headroom.

The Bank of England last week cut its growth forecasts to 0.75 per cent while consultancy Capital Economics is predicting expansion of just 0.5 per cent.

Even if the OBR does not go this far, any downgrade could be disastrous for Ms Reeves as she struggles to make her Budget numbers add up.

This is because weaker growth hits tax receipts – the amount of money the Exchequer brings in to pay for everything from schools and hospitals to the police and armed forces.

At the same time, subdued economic growth pushes up government spending on areas such as unemployment benefits.

Spending on servicing the national debt has also risen because interest rates on the global bond markets are higher – even though the Bank of England has cut its benchmark cost of borrowing.

So Ms Reeves is earning less than she hoped through tax, and spending more on benefits and debt interest payments – putting her fiscal rules at risk.

All this before any increase in defence spending – as demanded by President Trump.

Rachel Reeves was given a lifeline today as the economy unexpectedly grew in the final quarter of last year

The big problem is her so-called “stability rule” that states day-to-day government spending must be paid for by taxes.

The choices facing the Chancellor are stark.

She could break her fiscal rule. But this would be a political and economic humiliation from which she may never recover. And she continues to insist the rules are ‘iron clad’ and ‘non-negotiable’.

She could raise taxes. But the economy has already been brought to its knees by the tax hikes announced in October – including the £25billion national insurance ‘tax on jobs’.

And Ms Reeves may be reluctant to break yet another promise having told business leaders after the Budget that she was ‘really clear’ – ‘I’m not coming back with more borrowing or more taxes’.

So that leaves spending cuts by a Chancellor who has also promised ‘there won’t be a return to austerity’.

This sets the scene for a political showdown with her Cabinet colleagues whose departmental budgets are at risk and her public sector union paymasters.

But while the March 26 update from the OBR is proving a headache for Ms Reeves, it is the livelihoods of millions that are truly at risk from Britain’s economic malaise under Labour.