Chancellor Reeves must either raise taxes again or make sweeping cuts to services, leading economists have warned.

The Labour Chancellor raised taxes by a whopping £40billion in her bombshell budget in October 2024, but her plans failed to spark growth and prompted an exodus of wealth and business confidence.

As pensioners, farmers and businesses licked their wounds from punishing new taxes, the £10billion fiscal headroom the Chancellor left herself evaporated, while Labour’s approval rating tanked in the polls.

With very little financial breathing space, the Chancellor is now drawing up plans for fresh tax rises or spending cuts to try and get the nation’s finances back on track.

Rachel Reeves is scrambling to get the nation’s finances back on track after her disastrous budget

PA

It comes after Keir Starmer pledged to increase defence spending to 2.5 per cent of GDP, funded mostly by slashing the foreign aid budget, and after Work and Pensions Secretary Liz Kendall announced cuts to welfare worth £5billion.

Whatever fiscal measures the Chancellor has come up with are due to be unveiled in her Spring Forecast, due to be delivered on Wednesday, March 26.

While not a budget, the Tories have been busy painting next weeks’ announcement as an ‘emergency budget’.

Labour has been unable to quash those claims as they have not ruled out the possibility of tax rises.

What measures could be enacted?

It is believed the Chancellor favours cuts over fresh tax rises, a decision possibly made after farmers repeatedly gridlocked central London after being subjected to inheritance tax.

There is also the fact Labour’s must public promise pre-election was to ‘not raise taxes on working people’.

Here are five measures experts are expecting to see next week.

Tax Thresholds Frozen

One move that could significantly bolster the Treasury’s coffers is renewing the freeze on tax thresholds, which would not technically be a tax rise.

For this reason, Paul Johnson, the head of the IFS, said this move would be “relatively politically painless”, given that Ms Reeves could announce the change now but reverse it later if the economy improves.

Tax thresholds are meant to rise in line with inflation so that workers’ income does not fall in real terms.

But by freezing them, the Government gets to keep a larger share of workers’ rising wages, hence why it is called a ‘stealth tax’.

Then-Chancellor Sunak introduced the freeze when the nation was battling Covid in 2021, but it is set to end in 2028.

Reeves is said to be considering freezing the thresholds until 2030, something Starmer failed to rule out in PMQs this week.

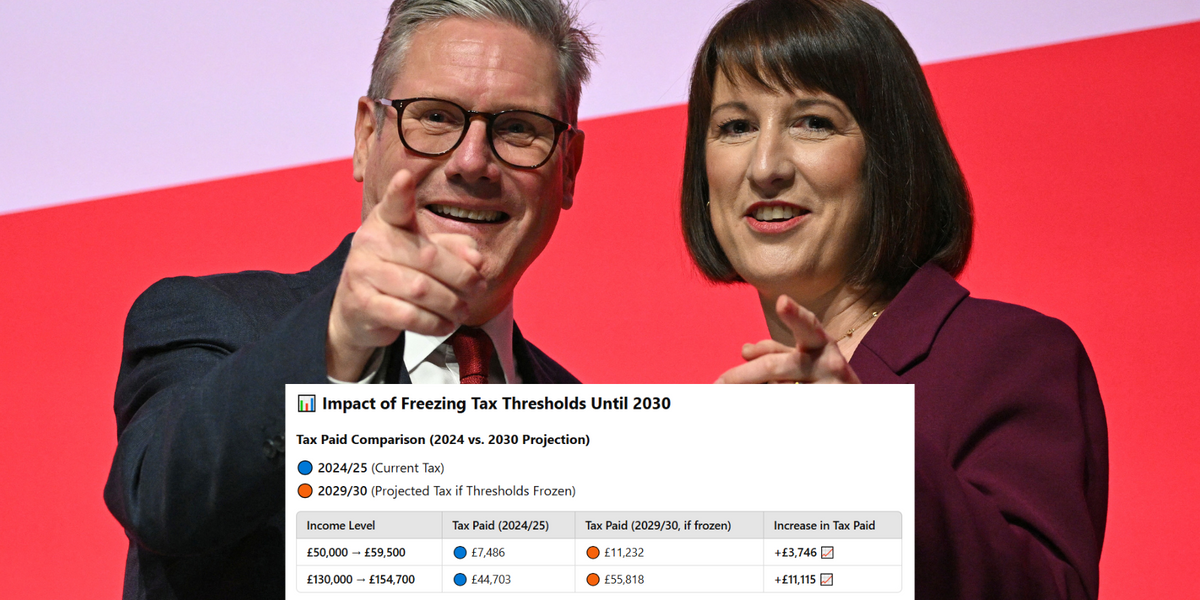

GB News analysis found taxpayers on an estimated income of £50,000 would see an extra £3,746 added to their income tax bills if the freeze was extended by 2030.

For those in the top bracket on £130,000, they would pay an extra £11,115 in 2030 if the freeze was to go ahead.

What could frozen tax thresholds mean for you?

What could frozen tax thresholds mean for you?

GBN

More Inheritance Tax Misery

Labour is also looking to further tighten inheritance tax rules. The party provoked fury for including farms and pensions in inheritance tax calculations in the budget, but some industry experts are expecting further refinements.

Britain’s ‘most hated tax’ is seen as anti-aspirational and unfair as it taxes savings that have already been taxed when they were earnt, but others say it fairly redistributes wealth and reduces inequality.

John Endacott, partner and head of tax at chartered accountancy firm Francis Clark said: “It is worth considering ideology. This government has pursued ideological policies on private school fees and the taxation of non-doms. The inheritance tax and capital gains tax changes can be seen in a similar light.

“I think further increases in inheritance tax are possible. The government has just published a consultation document around the restrictions of agricultural and business reliefs.

“It is more accommodating than we had been indicated it might be, but it still leaves open the opportunity for the government to make additional technical changes that could increase the revenue raised from inheritance tax.”

Tractors have descended on Westminster to protest changes to inheritance tax

GB NEWS

Ending the Triple Lock

One deeply unpopular- but potentially massively lucrative- measure would be to end the triple lock or significantly scale it back.

Currently, the state pension goes up by either 2.5 per cent, inflation, or earnings growth – whichever is the highest figure, hence why it is called the ‘triple lock’.

In April 2025, the state pension will increase by 4.1 per cent, making it worth:

- £230.25 a week for the full, new flat-rate state pension (for those who reached state pension age after April 2016) – a rise of £472 a year

- £176.45 a week for the full, old basic state pension (for those who reached state pension age before April 2016) – a rise of £363 a year

With an ageing population in Britain, the triple lock is one of the largest areas of Treasury expenditure, making it a prime target for reform.

John Endacott, partner and head of tax at chartered accountancy firm Francis Clark, said: “My sense is that there could be another big-ticket announcement – ending the triple lock, for instance, but even then, given the level of inflation and average earnings, would that make enough of a difference? Politically, it doesn’t sound much fun.”

Steven Cameron, Pensions Director at Aegon, warned that if Budget forecasts are weaker than expected, then Chancellor Rachel Reeves “can’t rule out a ‘rabbit in the hat’ review of the state pension.

“There’s already an ongoing review of the state pension age, and government finances may mean it needs to increase further or faster.”

“While the Government has currently committed to keeping it, the formula might be adapted,” he said, suggesting a smoothing mechanism.

He added: “Pensioners might receive an inflation increase as a minimum, and if, over the previous three years, wage growth has on average been higher than inflation, they could receive an additional uplift.

“This would protect pensioner purchasing power and make future costs less unpredictable.”

Pensioners already feel attacked after Labour removed the winter fuel payment

PA

Tweaks to Income Tax

Another measure Labour is considering is lowering the threshold for the 45 per cent additional tax rate from £125,140 to £100,000.

This move would expand the number of high earners subject to the top tax band without altering the rate itself, and going after the highest earners is easier politically.

Marc Acheson of Utmost Wealth Solutions noted: “Lowering the threshold for the 45% income tax rate to £100,000 would pull more earners into the highest tax band without changing the actual tax rate.”

GB News analysis reveals for those earning £110,000, they would be forced to pay £2,250 more per year in tax. This number rises to £11,250 for people earning £150,000.

LATEST FROM MEMBERSHIP:

How much it would cost if Labour lower top tax rate threshold to £100,000

How much it would cost if Labour lower top tax rate threshold to £100,000

GBN

Tearing up cash ISAs

ISAs are also in the crosshairs of Labour reform. In February, senior City executives met with Chancellor Rachel Reeves to discuss economic growth and ways to encourage greater investment from UK savers.

Among the proposals was capping the annual cash ISA allowance at £4,000, a significant reduction from the current £20,000 limit. Treasury officials have stated that the Chancellor is “listening to ideas.”

However, the Treasury has since confirmed that no immediate changes will be announced in the Spring Statement, meaning savers can still deposit the full £20,000 ISA allowance for the 2025/26 tax year.

If reforms do go ahead, they would not take effect before April 2026 at the earliest.

At present, individuals can open multiple ISAs each year and deposit up to £20,000 annually without facing tax on their returns – whether they invest the money or keep it in cash.

Critics argue that high cash ISA limits hinder UK investment, as many savers opt for low-risk, tax-free accounts rather than investing in the economy.

However, analysis by The Telegraph and accountancy firm Blick Rothenburg suggests that cutting the allowance would generate only £202 million in additional revenue for the Treasury.

The Treasury say they do not comment on fiscal speculation.